➡ Click here: 15 g form pdf

Other requests will be entertained on merits. I am confused about few points, can you please help clarify them. The purpose of this blog is to spread financial awareness and help people in achieving excellence for money. But with effect from 01.

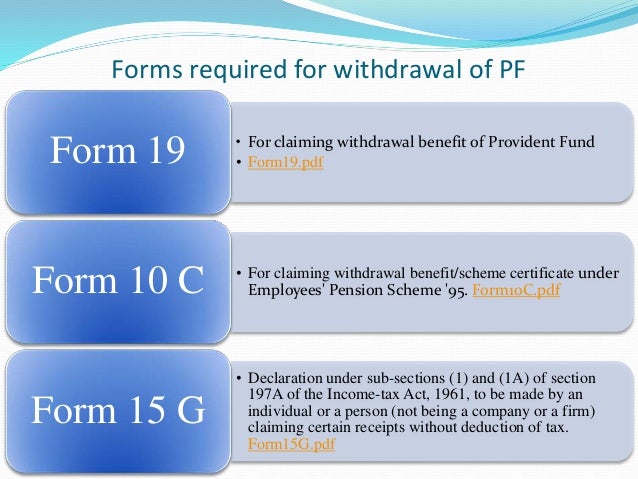

A complaint to the TDS section of the Income-tax Department, which is expected to enforce law regarding issue of TDS certificate con, should be the most effective remedy, if only the TDS cell activates itself to enforce the law and the rules on those responsible for tax deduction at source for the benefit of the taxpayers. Estimated income on form 15G means the income for which you are submitting the form 15G. You must intimate to your bank that tax on your total income is not zero. Do I need to submit form 15G to bank after opening. Where can I write the amount of pension. There is no option available to submit zip 15G in online, 15 g form pdf if you are withdrawing a PF amount of more than 50000 Rs in less than 5 yrs of service then you need to link your PAN number with your UAN number and that PAN number must be approved by the employer. Form 15G and Zip 15H are forms you can submit to make sure TDS is not deducted on your income if you meet the conditions mentioned below.

As I hav submitted both from 19 and 10c. If that happens, his total income may become 20000 for an FDR till March 31, 2017. Estimated total income from the source — I dont have such incomes — but got some interest credit in my savings account for the fund maintained through the year — should I be mentioning that here.

Form 15G in Excel / Fillable PDF - So the column of 15H furnished below : 1.

The revised procedure shall be effective from the 1st October, 2015. What is Form no. If your total income is below the taxable limit, you can submit Form 15G and Form 15H to the bank or any deductor requesting them not to deduct any on your interest. Form 15H is for senior citizens who are 60 years or older and Form 15G is for everybody else. Sreekanth Reddy Sreekanth is the Man behind ReLakhs. These should not be construed as investment advice or legal opinion. Is she going to claim any Tax deductions?? For Senior citizens the only condition is that their TAX LIABILITY Should Be Nil. Even if the Interest Income including submissions to all institutions exceeds the maximum Limit ,they can submit the Form 15 H. The total income means not GROSS INCOME. IT IS GROSS INCOME MINUS ALL ALLOWABLE DEDUCTIONS. IT IS THE TAXABLE INCOME. Means the tax liability should be NIL. Then is it necessary for her to have any allowable deductions? In column 15 of Part I by mistake YES has been checked instead of NO. My mother does not file her annual return so till date is not assessed to Income tax. The fault is on part of the bank authorities, but now they are refusing to accept their mistake. Now, Sir, please guide me about the procedure to correct or rectify that error. Till date i have not withdrawn my epf of the period 2009-2011. Currently i am drawing taxable salary, but will be withdrawing my epf. I have few queries for the same 1 do i need to submit form 15g 2 will my withdrawal be taxable and at what rate 3 in form 15 which AY should be written for previous years accumulated EPF withdrawn now. Now my income figures are as below Total annual Interest from F D :- Rs. I am Senior Citizen. My question is shall I submit Form 15 H before 31 st March 2017 or in the month of April 2017 and up to what date? If i dont submit Form 15 H before 31 st March 2017, will tax be deducted? Note :-I have already submitted form 15 H in the month of November 2016. I have given Nill in Column 23 to my Employer while opting for PF withdraw but they are repeatedly asking fill in the Column 23 and ship it once again. Can you please help me out. Appreciate your help in advance. Initially bank manager told to keep submitting 15G form as interest on FD should not be deducted as TDS. So she used to fill every year till last year. But as this year FY 2016-2017 the 15G format is changed she had doubts and did not fill. Now calculations…her annual pension FY 2015-2016 2,67,000 after deducting 15000 of exemption as Family Pension and it does not include any of interest of FD. And she did fill 15G last year thinking it wont cross the taxability limit. But tax was deducted as TDS as we dint fill 15G this year after seeing 26S form. So can I file tax return for FY 2016-2017 to claim deducted tax. Also when I calculated many of past few years pension, it crosses the taxable limit by couple of thousands. And 15G was filled for all those years. Did we file 15G forms incorrectly as we should be doing so. For Senior citizens the only condition is that their TAX LIABILITY Should Be Nil. Even if the Interest Income including submissions to all institutions exceeds the maximum Limit ,they can submit the Form 15 H. The total income means not GROSS INCOME. IT IS GROSS INCOME MINUS ALL ALLOWABLE DEDUCTIONS. IT IS THE TAXABLE INCOME. Means the tax liability should be NIL. For 15G The deductions are not allowed. FOR 15 G Two Conditions to be followed. It is clearly mentioned at point No. This is the only income I have, and I have been filing 15G manually in the previous years. When I checked with the bank branch, they said the maximum threshold for generating 15G is only 1. I was told that other banks are accepting 15G for upto 2. I am confused about few points, can you please help clarify them. The form 15H is futuristic, i. The main confusion is regarding the PY Previous Year concept. Estimated income for which this declaration is made:- is it income for FY2016-17? Estimated Total income of the P. Also why it is needed because I am filing for FY2016-17? Also why column 15 income is to be included 17. Details of Form No 15H other than this form filed for previous year, if any:- Again why the 15H of the previous years? A little clarification on boxes 14, 15, 16, 17 will really be very helpful. Are both TDs and RDs interest taken together for total income calculation for AY-17-18. Is it on accrual or paid basis. Since interest accrue gradually increased due to compounding. But My home branch is located in Lucknow and I am living in Delhi. Is there any way I can do all the process from Delhi itself without going back to Lucknow. I have researched enough there is no way you can do it Online. Can I do it from any local Delhi branch?? I submit 15H form in April2015 assuming that my total income does not exceed Rs 300000. Now I calculate my pension for the year ended 31march 16 was Rs 220000 and interest from fixed deposit Rs 130000. I bought Senior Citizens Savings Scheme Rs 60000 in march 2015. This scheme qualifies for the benefit of Section 80C. I also submit income tax return next month. My question is now can I submit 15H form in april for this year or not? Suppose this year also my income about to same last year and I will buy NSC or Senior Citizens Savings Scheme and bring down my total income in limit. My estimated interest income for 2016-17 will be around Rs. Every year I invest Rs. Thus my total tax liability for the year will be Nil. The deposits are spread out in 4-5 banks so that interest income from any one Bank does not exceed Rs. I am religiously submitting form 15 G to all these Banks and thereafter filing my IT return. In the old format, the information to be submitted only pertained to estimated income for the year. It was only an estimate and if I submitted a lower income, it did not tantamount to submitting false information, and I was sure that at the end of the year my tax liability would be Nil. Now in the revised format, information about 15 G forms submitted to other banks is also required to be furnished. Thus it now becomes impossible to submit the form,as the total income exceeds Rs. If I submit correct information, TDS of around Rs. Is there any way out to ensure that my TDS deduction is Nil? I had been submitting my declarations for no TDS in Form 15H for two years to their Delhi office. This branch office told me verbally they have received an internal memo from the Registrar of their company, advising not to accept from their investors any more Form 15 H in paper form next FY -2016-17. I think the new Rule does not make any change in Form 15 H or its paper form submission by investor to the person responsible for paying the income. On the other hand, the new rule makes it obligatory for the person responsible for paying the income to allot a UIC in the form and to simplify the procedure, transmit the information of Form 15H to tax authority through a electronic process, instead of physical form. If they do so, it would be a violation of Govt. On the other hand, the Payee in this case, Muthoot Finance will be under an obligation to generate and assign an UIC in all Forms- 15H received by them from investors and transmit relevant detail quarterly to Income Tax authorities through Electronic Process Only. Also,the Payee will be required to maintain all Form 15-H received for a period of 7 years or so. I have account in TNSC bank, so i need to fill part II of 15G by myself and submit to the bank or the pf office along with form 10c and 19…. But actually it is not like that and firstly we have to take UIN and then that no.